Glory Info About How To Become A Tax Filer

Clarified who should file taxes and the.

How to become a tax filer. How to become a tax filer? Minimum fee, plus complexity fee: Becoming a tax filer:

As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200. Here we provide details of tax filing. Are you required to file a tax return in pakistan?

If you spent $12,000, you can claim 20% of your first $10,000 in costs, or. In conclusion, in order to file taxes, you must gather all of your income statements, ascertain your filing status, and complete the necessary tax forms. $345 (new client), $332 (returning client) set fee per form and.

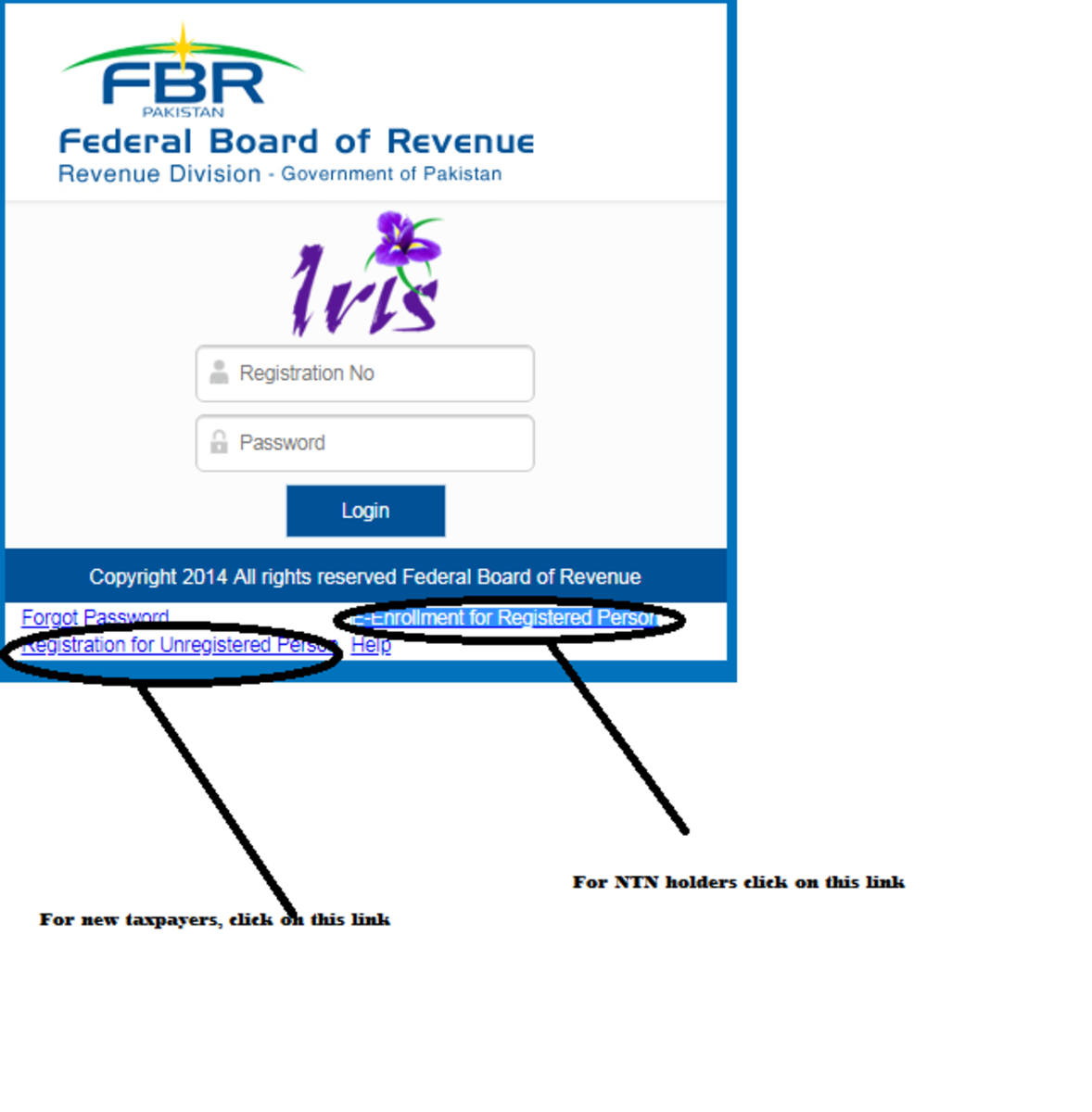

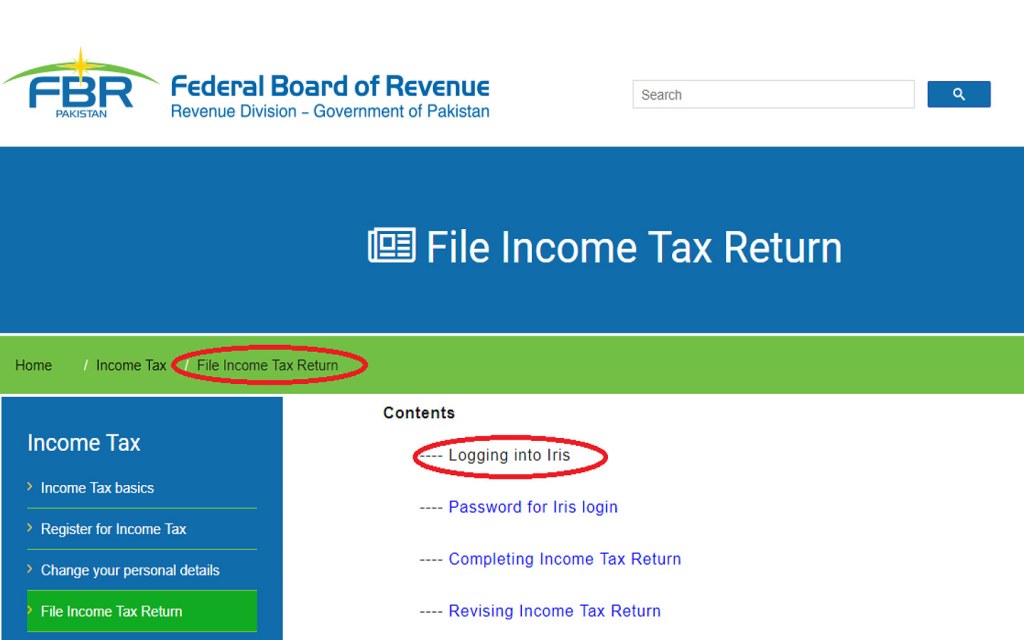

Your first step in becoming an electronic filer is to complete the efile registration online form. Also the federal board of revenue (fbr) is the central tax. For income tax registration individual can register online through iris.

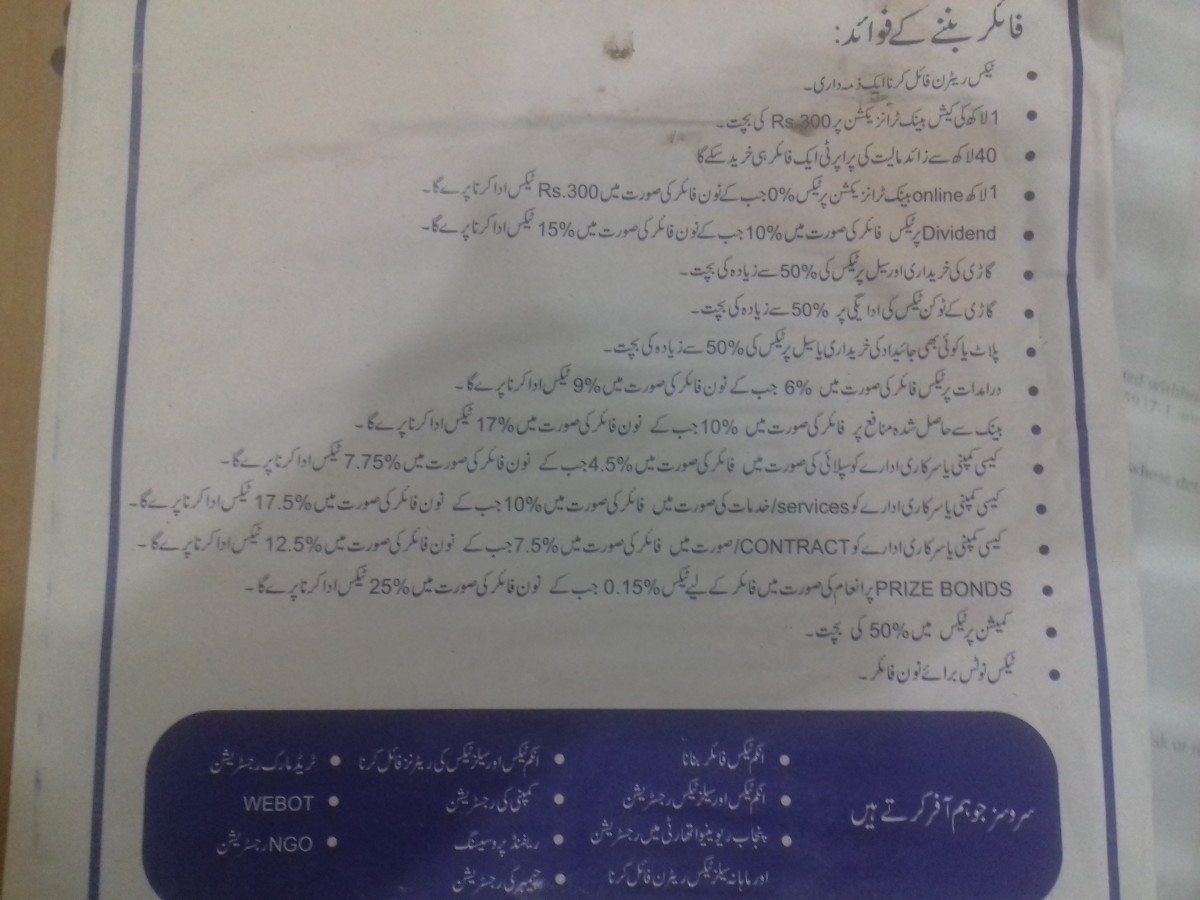

Becoming a tax filer in pakistan is essential for individuals and businesses who want to meet their tax obligations and stay compliant with the law. Becoming a tax filer needs you to be earning at least 600 rupees. Understanding the updated filing requirements befiler january 23, 2024 hello there, tax filers!

First, you will need to take a course to receive certification. The first step of filing your income tax return is to register yourself with federal board of revenue (fbr). Here’s what tax preparers charge, on average, by fee method:

Learn how to become a tax filer, what skills you need to succeed, how to advance your career and get promoted, and what levels of pay to expect at each step on your career. It shows two following options: Complete your education a high school diploma or ged is the minimum education requirement at many tax preparation companies.

Feb 24, 2024, 6:00am pst. How to become a tax filer is a common question. There’s a lot more to say about it.

Due to the lack of information, people tend to become panic. We’ll walk you through what a tax preparer does and a few common paths to learning income tax return preparation, as there’s no one tax preparer course for u.s. First and foremost, the federal board of revenue (fbr) is the government’s tax agency.

Your filing status can affect the tax credits you receive and how much. Here’s the process to obtain an efin: This should not be the case.