Lessons I Learned From Tips About How To Claim Back Ni

You don’t apply for a rates refund but you.

How to claim back ni. Help if you're not working. This tool helps you apply for a refund on your national insurance contributions from hm. National insurance credits can help to avoid gaps in your record and.

Last modified on wed 28 feb 2024 01.02 est. Hm revenue and customs. Fix a national insurance contribution payment if you paid an employee the wrong amount after 6 november 2022.

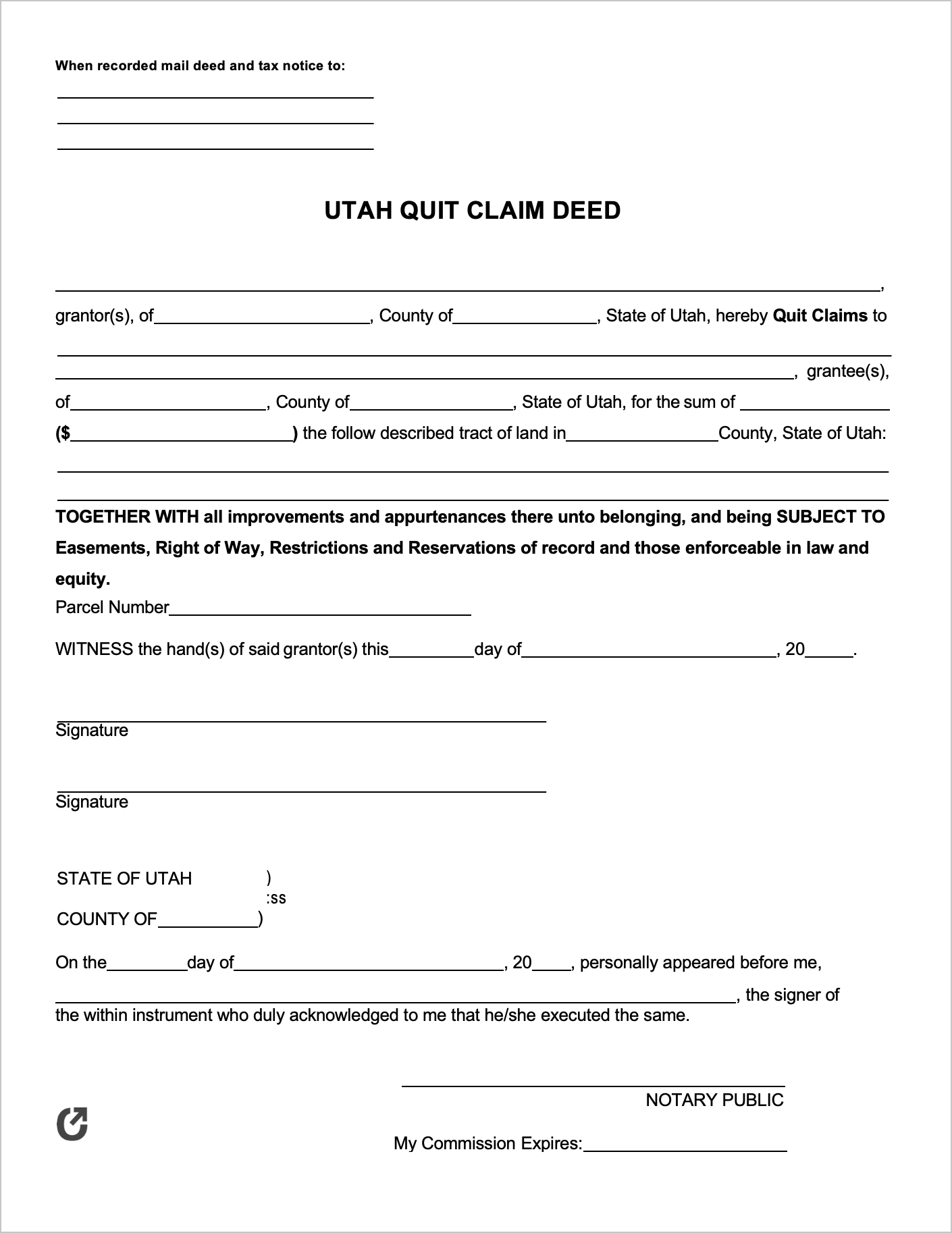

That means that everyone earning over £83,001 will start paying class 2 ni. To start a claim for a national insurance refund (external link) see gov.uk's website. The allowance increased to £4,000 (was £3,000) from 6.

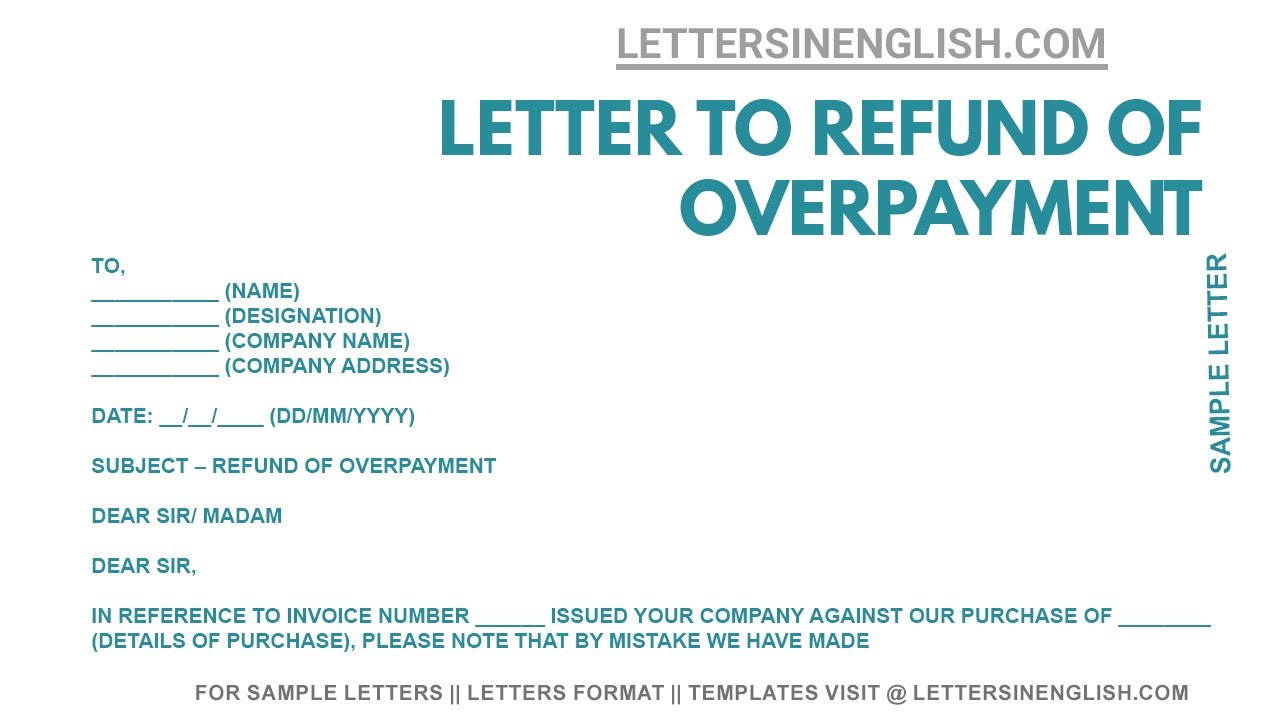

Getting a rates refund. Check you're not being taxed, as that is a long nightmare to claim back, but any week you earn over the ni. Whichever one has the higher income will have to pay back the full amount via the tax.

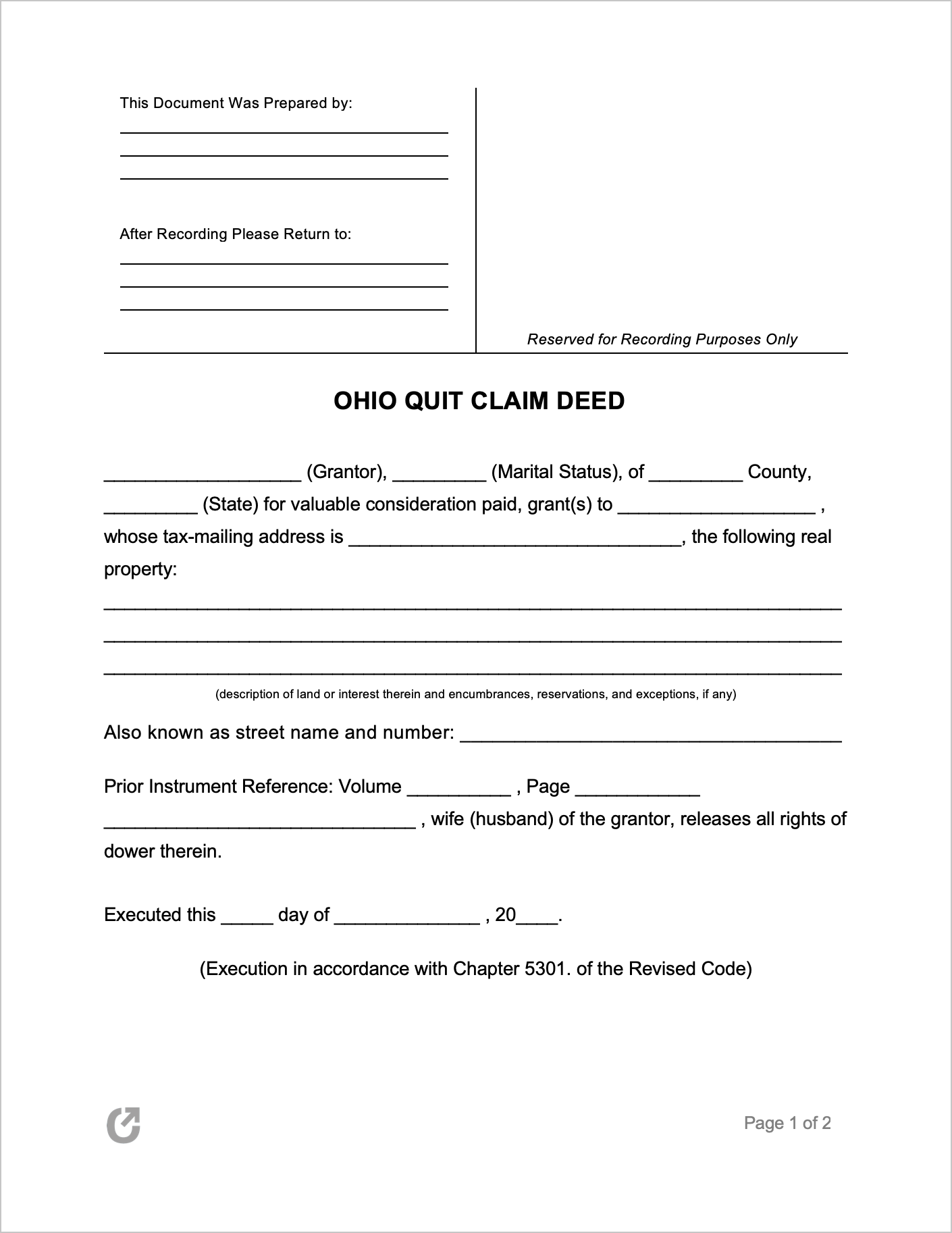

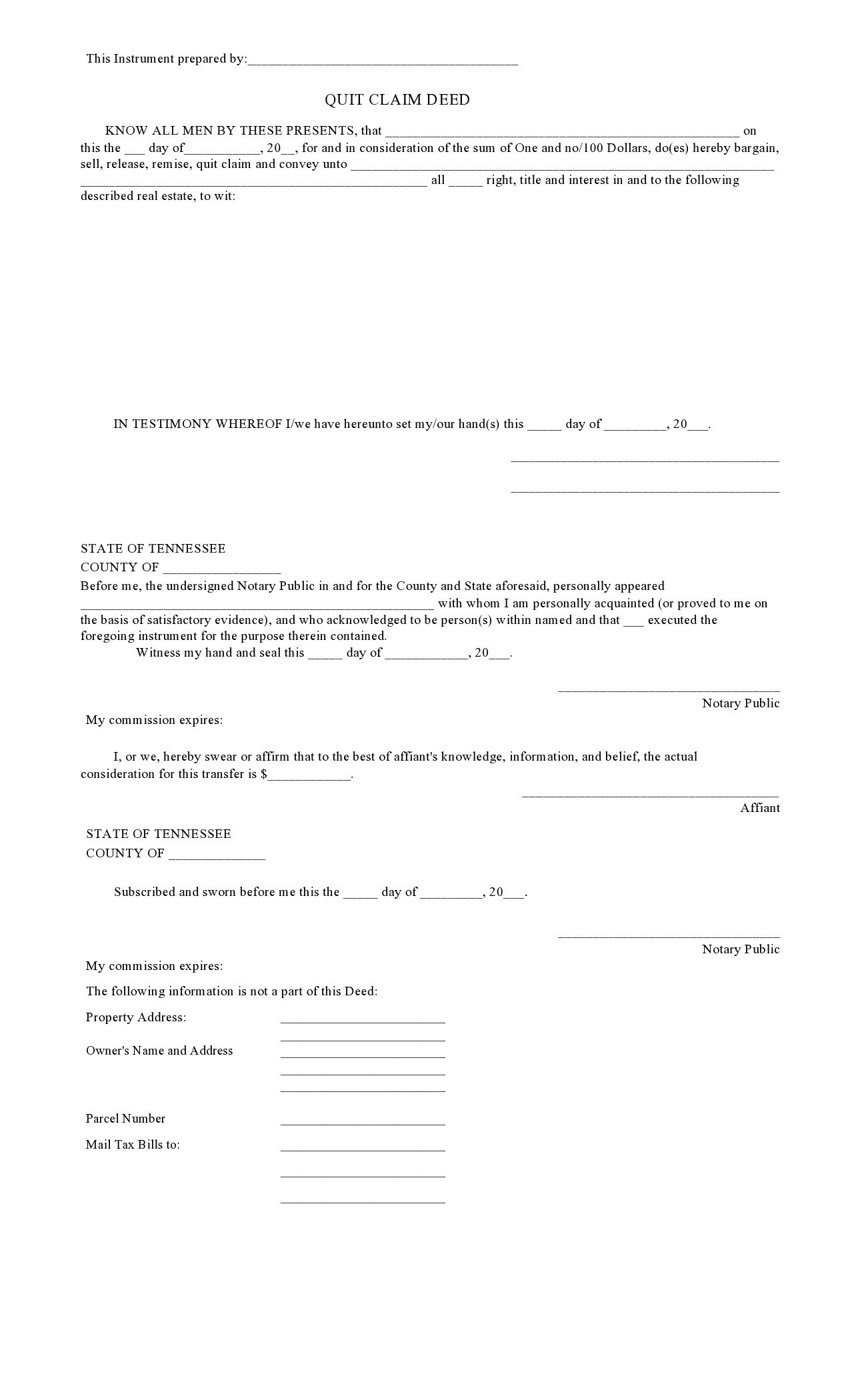

You could get a rates refund if your circumstances change and you overpaid rates on the property you live in. National insurance refunds on this page you will find information about: Your benefits could be affected if there are gaps in your national insurance record.

It just means that it may take a bit longer as hmrc seek verification of your. Allegations that uk police and intelligence spied on investigative journalists to identify their sources will be heard by. The extent to which overpaid nic can be refunded, and the mechanism for reclaiming, depend on the.

14 february 2023 if you’re employed; There are different procedures depending on the class of nics and the reason that you are. All the information to claim back a national insurance refund is on gov.uk.

On 6 april 2023, we’re aligning the class 2 ni threshold with the class 4 ni threshold. Hm revenue and customs national insurance contributions and. Calls cost up to 12p a minute from landlines and.

Send your letter to the following address, using the reference ‘nilevy061122’: It is still possible to make a successful tax relief claim without your national insurance number. You may be able to claim a refund for previous tax years.

1 september 2022 if you stayed at home to care for family, as far back as 1978, your national insurance (ni) record may have been hit with errors that could see you missing. 2nd jan 2019 national insurance contribution (nic) overpayments do arise. April 20, 2021 employment the employment allowance allows eligible employers to reduce their national insurance liability.