Fine Beautiful Info About How To Handle An Audit

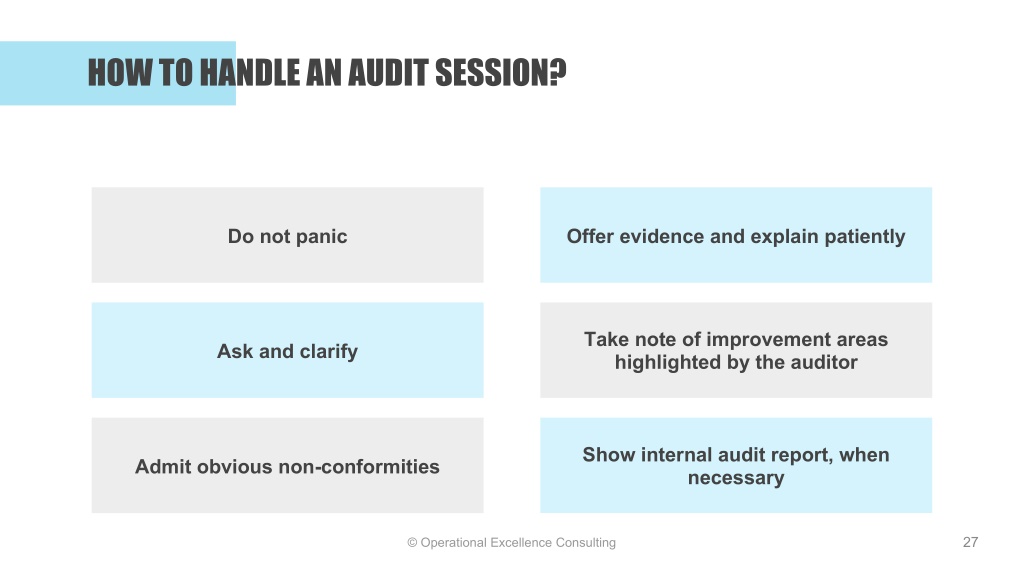

Planning the internal audit opening meeting conducting the internal audit closing meeting follow up.

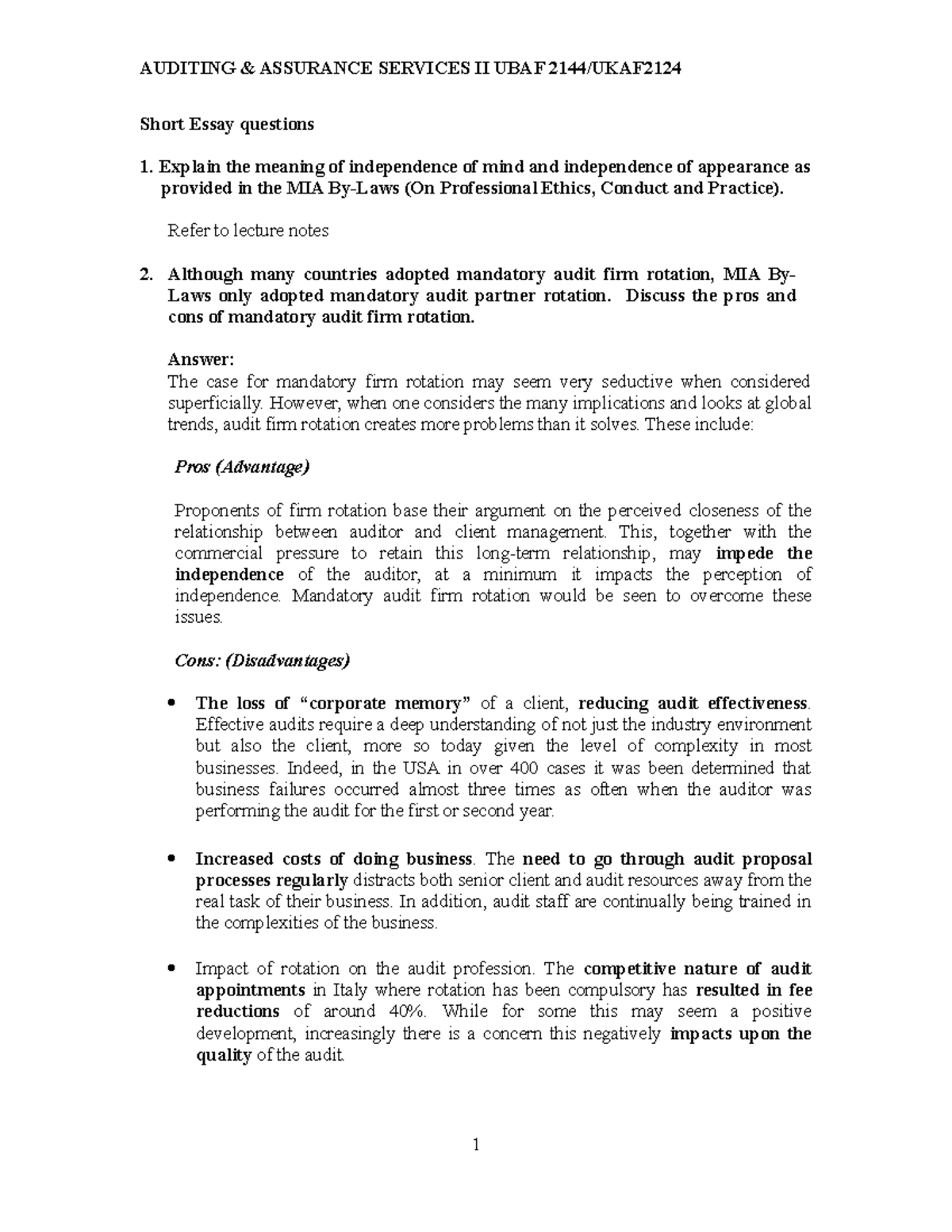

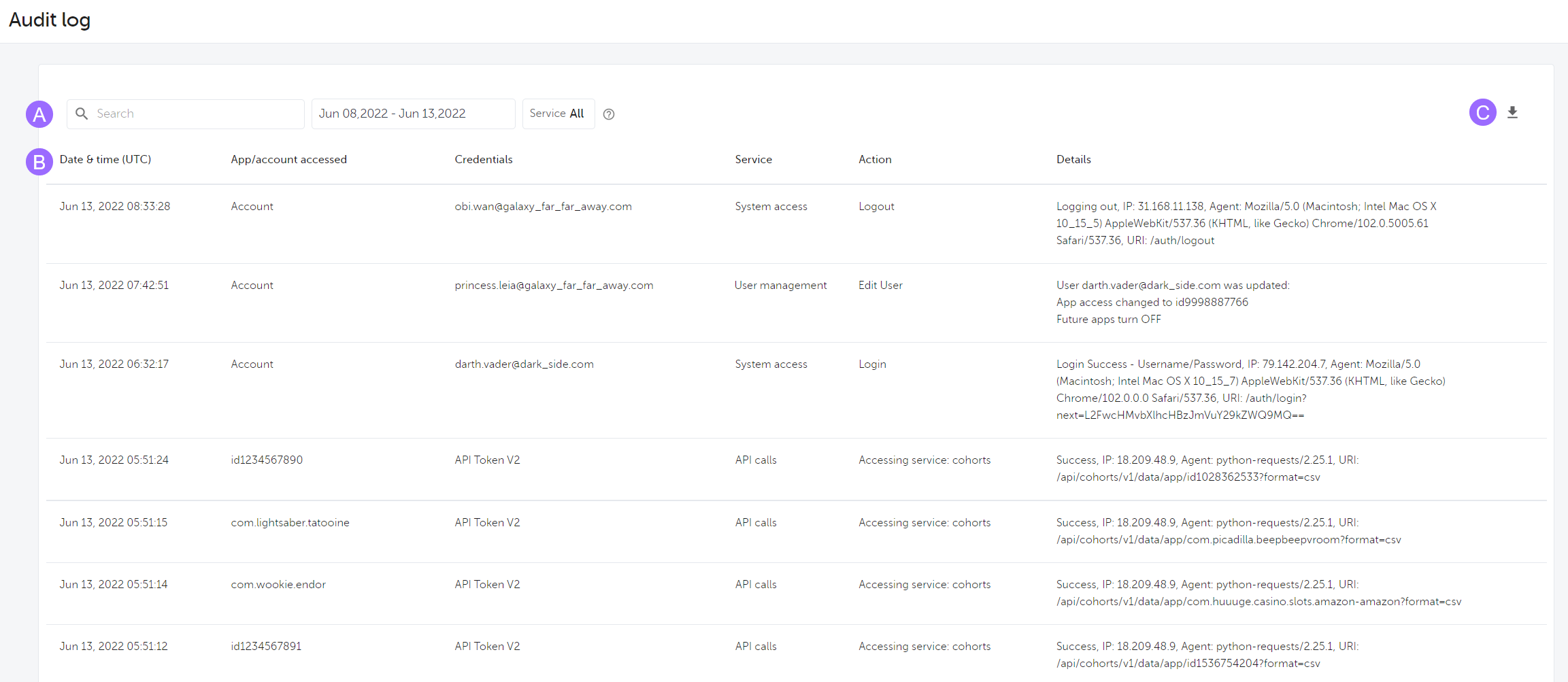

How to handle an audit. The first step in the invoice audit process is triggered. Regardless of how your audit is conducted, work with an expert to guide. In this podcast episode, we discuss how to handle auditors from the perspective of the controller, and specifically, when to.

Ask to speak to the. Internal audit will only fully achieve its objectives. You may picture a tax audit like a.

If the audit is not going well, demand a recess to consult a tax pro. Getty images once you receive. It may be a few months or a few weeks, depending on.

Let’s take a deeper look at each of the steps in this process. Get training on dealing with difficult people. Internal audit assesses how risk appetite is set, although it’s unlikely to challenge the actual risk appetite set, unless this is extreme.

Auditees take a communication class on verbal and nonverbal skills. Whoever is accountable for the audit process should be familiar with the scope of the process, from selecting the audit firm and negotiating the agreement with the auditor, to. How to address an irs audit 1.

If you have a licensed practitioner handling the audit, help your tax pro with the facts, and your tax pro will work with the irs. It needs to be certain that any auditor is absolutely objective in their assessment. Explain to the auditee the benefit or requirement to the company.

By susannah snider, cfp | nov. Keys to success in handling an irs audit include being well prepared, establishing credibility, and keeping. The first step to prepare for an audit is to review your organization’s last audit with an eye for issues cited and correct those in advance.

Therefore, it is required that. Next, identify areas of risk. Tax audits usually start with a letter, and in most cases the irs handles them entirely through correspondence.

Browse irs publication 1, explaining the taxpayers' bill of rights, prior to your audit. Further complicating the council's financial landscape was the discovery of issues within the appointeeship process, a critical function wherein the council manages. The four primary steps of invoice auditing.

The checklist should include items related to: Here are 7 best practices in internal audit management and how they can help you evolve internal audit from compliance to strategic advantage. How to handle an irs audit of your tax return.